Why Super Visa Insurance Is a Must-Have for Parents Visiting Canada in 2026

Why Super Visa Insurance Is a Must-Have for Parents Visiting Canada in 2026

Canada’s Super Visa program is one of the most popular ways for immigrants to reunite with their parents and grandparents for extended visits. In 2026, thousands of families are applying to bring their loved ones from countries like India, Nigeria, the Philippines, Vietnam, Sri Lanka, and more. But before your application is approved, there’s one non-negotiable requirement: Super Visa Insurance.

At DaddySafe.ca, we make sure immigrant families across Canada can easily find the right insurance for their Super Visa application with complete transparency and care.

What Is Super Visa Insurance?

Super Visa Insurance is emergency medical insurance for parents and grandparents of Canadian citizens and permanent residents. It is mandatory for every Super Visa application.

The insurance must:

Provide at least $100,000 CAD in medical coverage

Be valid for a minimum of 1 year from the visitor’s arrival date

Be issued by a Canadian insurance company

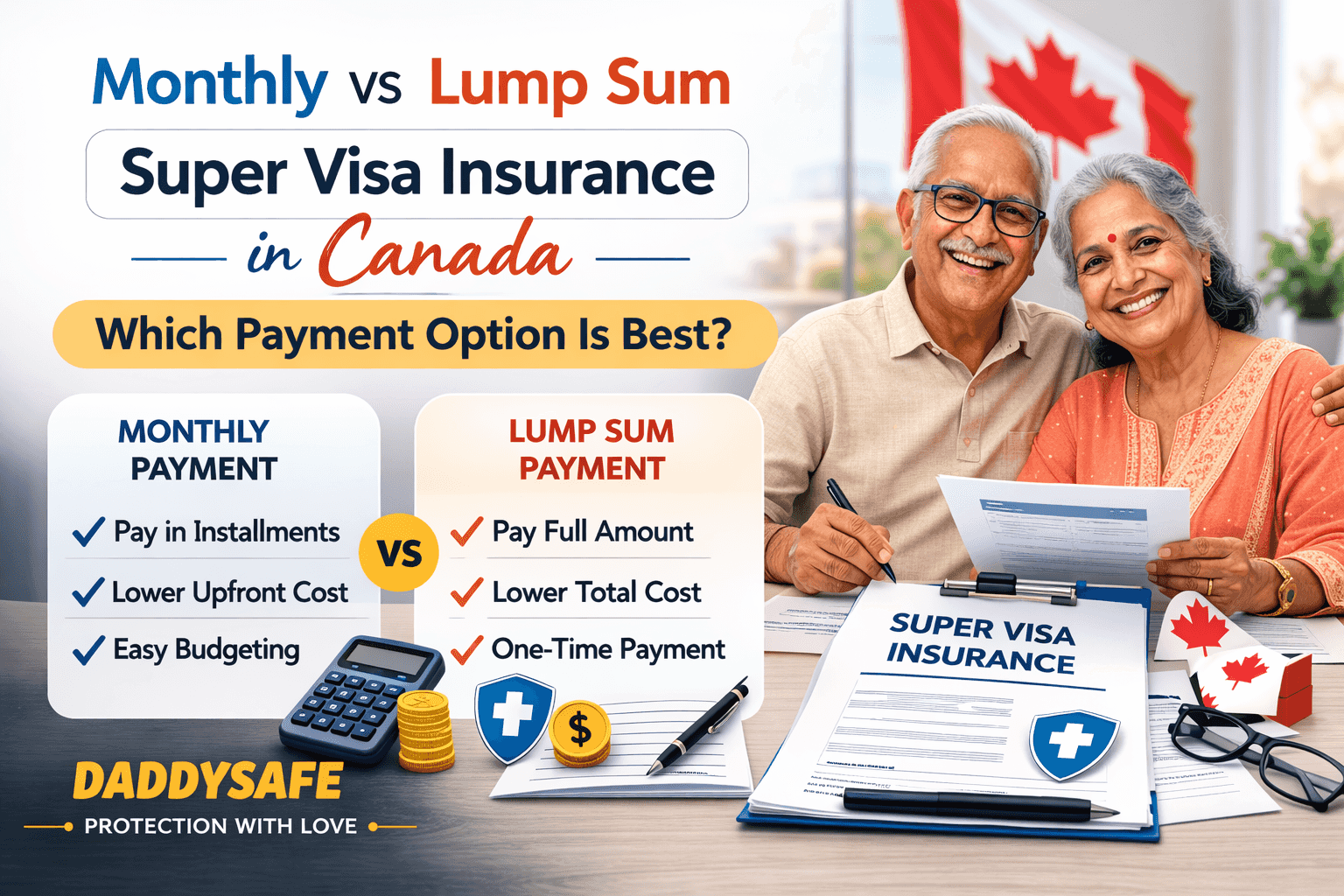

Be paid in full or through an approved monthly plan before the visa is granted

Why Is Super Visa Insurance So Important in 2026?

In Canada, visitors are not covered by public healthcare like OHIP or provincial plans. This means a single emergency a hospital stay, surgery, or ambulance ride can cost thousands of dollars.

Super Visa Insurance protects you and your family from:

High emergency hospital bills

Costs of emergency surgeries and treatments

Medical transportation and air ambulance if needed

Prescription medication during emergencies

Medical repatriation (returning the visitor back home)

Key Benefits of Buying Super Visa Insurance in 2026

✅ Meets IRCC requirements for Super Visa approval

✅ Covers pre-existing conditions (if stable) depending on the plan

✅ Refundable options if visa is denied or travel plans change

✅ Monthly payment plans available with top providers

✅ Instant documents for fast application processing

Who Needs Super Visa Insurance?

If you are:

A Canadian citizen or PR sponsoring your parent or grandparent

Applying for a Super Visa valid for up to 5 years

Hosting a visitor from India, Nigeria, Philippines, Sri Lanka, Pakistan, Vietnam, China, UAE, or any other country

Then Super Visa Insurance is mandatory.

What Does Super Visa Insurance Cover?

Most plans from licensed Canadian providers include:

Emergency hospital stays

Medical tests (X-rays, blood work, scans)

Prescription drugs for short-term use

Emergency dental care

Transportation to medical facilities

Return of remains in case of death (repatriation)

Some plans even cover stable pre-existing conditions, depending on age and medical history.

DaddySafe Makes It Simple

At DaddySafe, our platform compares Super Visa Insurance quotes from multiple trusted Canadian providers. We’re here to:

Help you find affordable plans that fit your family’s needs

Make sure you meet all 2026 immigration requirements

Explain deductibles, pre-existing condition coverage, and refund policies

Offer support whether you’re in Toronto, Calgary, Edmonton, Vancouver, Surrey, Mississauga, Brampton, Ottawa, or anywhere else in Canada

Final Word: Super Visa Insurance = Peace of Mind

Reuniting with your parents or grandparents is a priceless experience but it comes with responsibility. In 2026, don’t take chances. Ensure your family is protected from financial surprises with the right Super Visa Insurance plan.

Visit DaddySafe.ca to compare, choose, and buy Super Visa Insurance.

Related Blogs